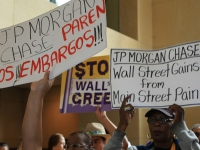

JP Morgan Fined Over $1 Billion for Wall Street Scams

JP Morgan, the Wall Street investment bank, has been fined $920 million for violating trading laws that were discovered after trader Bruno Iksil (nicknamed the "London Whale") lost billions in bets last May. It was also fined over $80 million for credit card scams in an unrelated incident.

In the first incident, JP Morgan agreed Thursday to pay $300 million in fines to the U.S. Comptroller of the Currency, $200 million to the U.S. Federal Reserve, $200 million to the U.S. Securities and Exchange Commission and £137.6 million ($219.74 million) to the U.K. Financial Conduct Authority (FCA).

Iksil, a London based trader for JP Morgan, lost much of his money to Boaz Weinstein from Saba Capital Management in New York. The two men are known as "whales" in the financial markets because of the size of their bets, which often run into billions of dollars. Winning and losing huge sums of money at this game, is considered part of the Wall Street culture. Indeed Weinstein previously lost $2 billion in such bets when he worked at Deutsche Bank. But there are reporting rules that these traders are supposed to follow to make sure that they do not cheat the public.

Iksil, whose nickname has become synonymous with the scandal, has not been charged with any offenses to date, possibly because he has been cooperating with the government investigation into the losses (estimated at $6.2 billion).

On the other hand, two of his colleagues - Javier Martin-Artajo and Julien Grout - have been accused of criminal conduct. Martin-Artajo was in charge of trading strategy for the "synthetic credit" portfolio in London while Grout was a trader under him. In August, a grand jury charged them with manipulating and inflating "the value of position markings in the Synthetic Credit Portfolio in order to achieve specific daily and month-end profit and loss objectives" and to "artificially increase the marked value of securities in order to hide the true extent of significant losses in that trading portfolio."

Grout's lawyers allege that Iksil is really the one who is at fault. "It is astonishing that the prosecutors are relying on Iksil's testimony when he is the one who taught Mr. Grout how the bank was marking the portfolio, gave specific instructions on where he should mark positions, and personally approved the marks on a daily basis," Ed Little, a partner at Hughes Hubbard & Reed LLP, told Bloomberg in an e-mailed statement.

The FCA report gives an example of how one JP Morgan report in May 2012 switched plus and minus signs that altered figures for losses from $512 million to about $275 million. "The error, identified late in proceedings, gave the controller's office pause for thought," reports the FCA, but the ultimate conclusion was that "no further work was necessary".

The Guardian says that the FCA's report reveals "the bank's almost comical inability to get a handle on its credit derivative exposures even after senior management realised there was a crisis."

Despite the size of the fine - close to a billion dollars - observers are skeptical that much will change. "It's an admission that they were careless and should have done a better job with their internal controls," Adam C. Pritchard, a professor at the University of Michigan Law School, told the Washington Post. "But it doesn't have serious implications for the private lawsuits they are facing."

Separately - but on the same day - JP Morgan was also charged with selling credit card customers bogus services - such as credit monitoring products that were often offered as 'add-ons' to credit card accounts. "Put simply, Chase was charging consumers for services that they did not receive," said Richard Cordray, a director of the U.S. Consumer Financial Protection Bureau (CFPB). The agency - together with the Controller of the Currency - ordered the bank to pay $80 million in fines plus $309 million in restitution.

Still, shareholders aren't going to be too upset about the fines, since they add up to just five percent of net profits of $21.3 billion that JP Morgan made in 2012.

- 185 Corruption